BOI Reporting- A Simple, Step-by-Step Guide

Welcome to our BOI Reporting Guide, a straightforward, step-by-step approach to help you navigate the new filing requirements under the Corporate Transparency Act.

If you’ve read our previous post on the BOI filing requirements, and want some guidance to submit your report, please use these general step by step instructions. If you have specific questions, please don’t hesitate to ask:

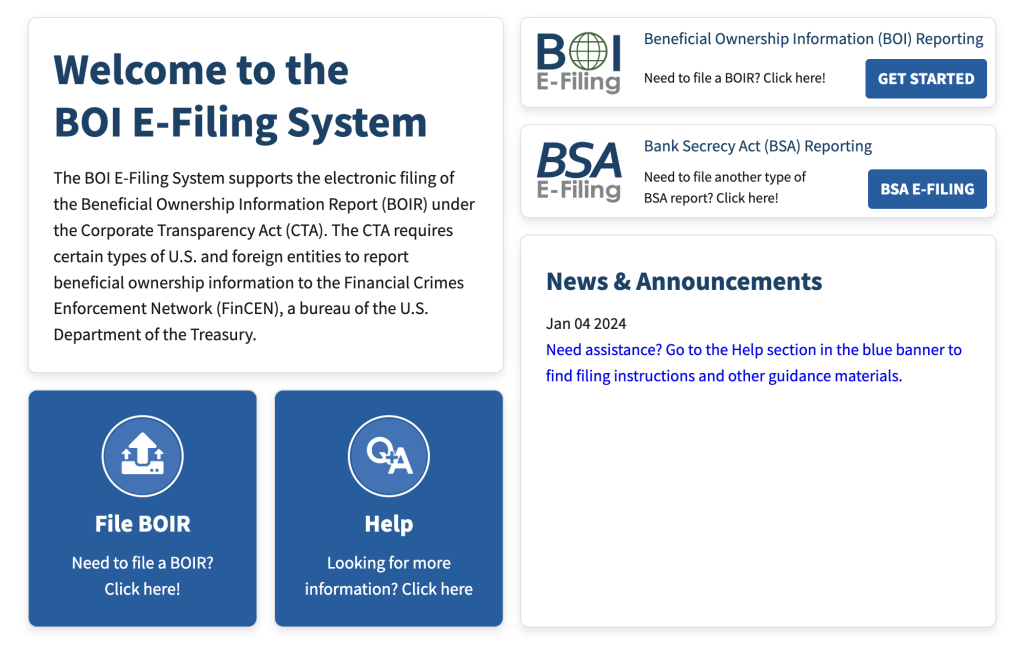

Step 1: Head to the BOI Filing System

Go to the landing page for BOI E-filing, HERE.

Then, choose “File BOIR.”

Step 2: Prepare Your BOI Report

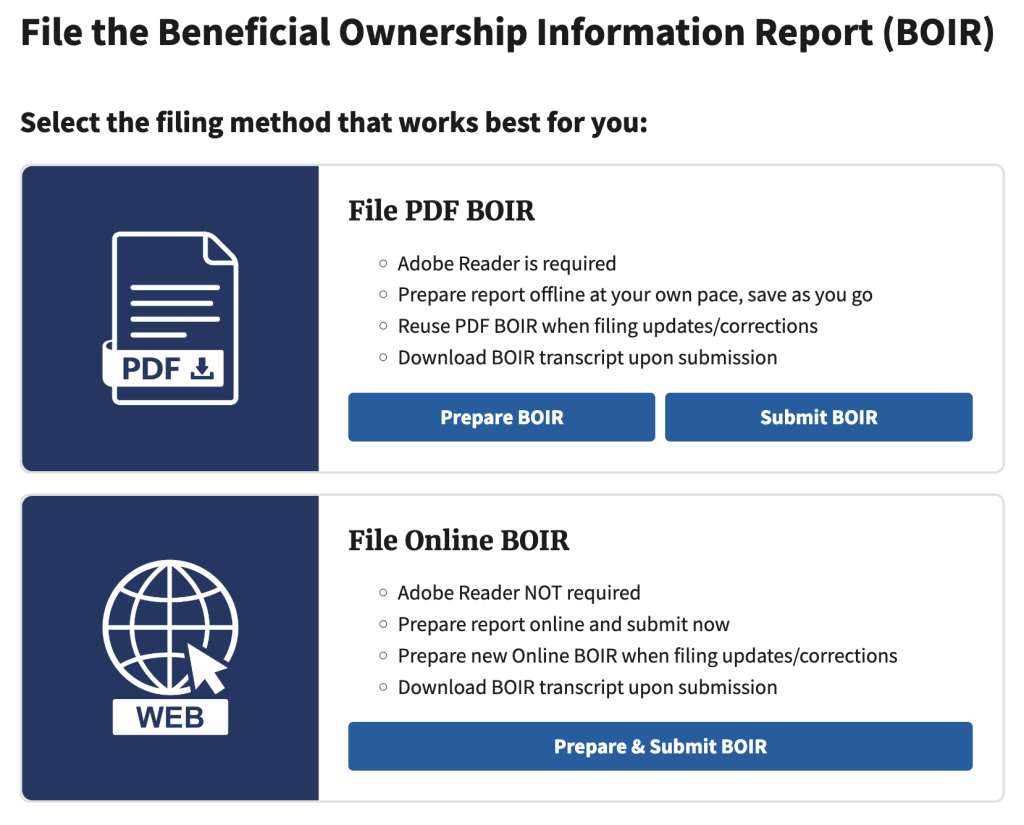

Once you’ve chosen “File BOIR,” you will then click “Prepare & Submit BOIR.”

This will walk you step-by-step through the report as follows:

- Filing information

- Type of filing (initial report)

- Date (auto filled)

- Reporting Company Information

- Request to receive FinCEN ID- only if you want it to make reporting for multiple companies easier.

- Legal name and DBA name

- TIN Type (EIN, SSN, etc.)

- TIN- enter 9 digits with no dashes.

- Country of formation

- State of formation

- Address

- Company Applicant- This section is to report the individual or firm who formed the entity by filing documents with Secretary of State or equivalent. A reporting company that existed as of January 1, 2024 is exempt from providing this information, as FinCEN can get it directly from the State.

- Existing reporting company- check this box if the entity you are reporting existed before January 1, 2024. If you check this box, you do not have to complete any more Company Application information.

- If you do not check the box, you most provide the company applicant’s FinCEN ID, legal name, date of birth, and identification information (including an image of the document).

- Beneficial Owner Information

- Enter FinCEN ID if you have one. If you enter this ID, it exempts you from completing the rest of the form.

- Owner information- enter all required information- legal name, date of birth, address, identification information, and an image of the identification.

Step 3: Submit Your BOI Report

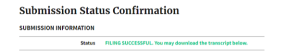

Once you’ve submitted, you’ll get a confirmation with your BOIR ID, tracking number, and the ability to download a transcript. We recommend printing a copy of each for your records.

Annual reports are not required. Updates are only required to be filed when relevant information changes- name or address change, beneficial ownership change, or identification information changes (i.e. passport or driver’s license expires).

Get a PDF Version of Our BOI Reporting Guide

If you’d like a copy of the Step-by-Step BOI Reporting Guide, we’ve got you covered! Feel free to download it, share it with your firm, and even with your clients.

Need Further Assistance?

If you have any questions about the BOI reporting process or need personalized guidance, don’t hesitate to reach out to us at Watson & Associates. Our team is here to help you navigate these new requirements and ensure your filings are accurate and compliant. Contact us today to get the support you need!